With the high cost of post-secondary education these days, and given that your children and grandchildren need an education to compete in our very competitive world, what is the best way to save for their future educational needs? If someone told you that for every dollar you saved for them, the government would give you 20% automatically, would you be interested? Where else can you get a 20% bonus? Well, it’s true. With a Registered Education Savings Plan (RESP), the government will add 20% to your contribution.

Here’s how it works.

You can open an RESP account for your children or grandchildren – or just about anyone for that matter, but let’s stick to the first two for explanations. You can contribute a maximum of $2,500 per child per year and the government will add 20% to the total. So a contribution of $2,500 gets an additional $500 from the government. That’s 20% right away; no need to wait. You can invest the money in a variety of vehicles, including savings accounts, mutual funds, stocks, etc. The money that you earn in this account continues to grow tax free for the entire period that it is invested. It will be taxed on withdrawal, but it will be taxed to the beneficiary (the student), who will most likely not have much income because they are in school and so will pay a very low tax rate. The contributor (subscriber) does not get a tax deduction for their contributions, but the money’s growth is tax sheltered while it is in the account, until it is withdrawn for educational purposes. The lifetime maximum government grant is $7,200 per child and you can contribute a lifetime maximum of $50,000 per beneficiary.

There are different types of plans that cater to different situations. For instance, a family plan can include more than one child, and you can allocate monies to any of your children depending on how much they need for school. There are rules for withdrawals, but as long as the monies are used for education as intended, there are no penalties.

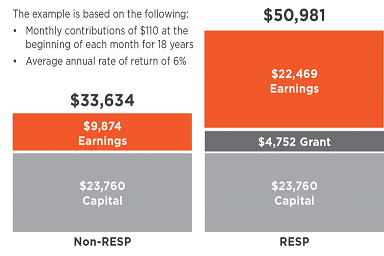

The chart shown below illustrates how a contribution grows within the plan versus the same contribution outside the plan over the course of a child’s first 18 years. The contribution used for the example does not even maximize the total grant available, yet still produces a significantly higher return than a non-grant vehicle.

Earnings from contributions and grants invested in an RESP grow tax-free until the beneficiary begins post-secondary studies. The graph clearly illustrates the advantages. In fact, a monthly investment of $110 over 18 years yields $17,347 more when invested in an RESP.

If you wish to learn more about RESPs or have any questions, please feel free to contact one of our Financial Services Representatives. We will be pleased to show you the logistics of investing in this great vehicle so that your children or grandchildren will have the opportunity to realize their dreams of higher education in the competitive world we live in.